Dear Oracle Stock Fans, Mark Your Calendars for September 9

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Notable tech giant Oracle (ORCL) is having a solid time on Wall Street at the moment. The company has identified cloud expansion as the driver of its next growth phase, alongside the aggressive venture into multicloud expansion. The company is also incorporating artificial intelligence (AI) into its cloud stack.

Amid all this, the company is expected to report its first-quarter results for fiscal 2026 today, Sept. 9, after the market closes.

About ORCL Stock

Oracle, based in Austin, Texas, is a prominent player in the global tech industry, known for its enterprise software and cloud services. The company designs and delivers database technologies, cloud infrastructure, and a wide range of business applications. Oracle's solutions encompass its flagship database systems and cloud platforms, including Oracle Cloud Infrastructure (OCI), which provides support for computing, storage, networking, and AI tools.

It also offers cloud-based applications for enterprise resource planning (ERP), human capital management (HCM), and customer experience (CX). Serving organizations across diverse sectors, Oracle helps companies streamline operations and embrace digital innovation. With a strong focus on security, scalability, and performance, Oracle remains a key driver in modernizing IT systems worldwide. The company has a market capitalization of $653.90 billion.

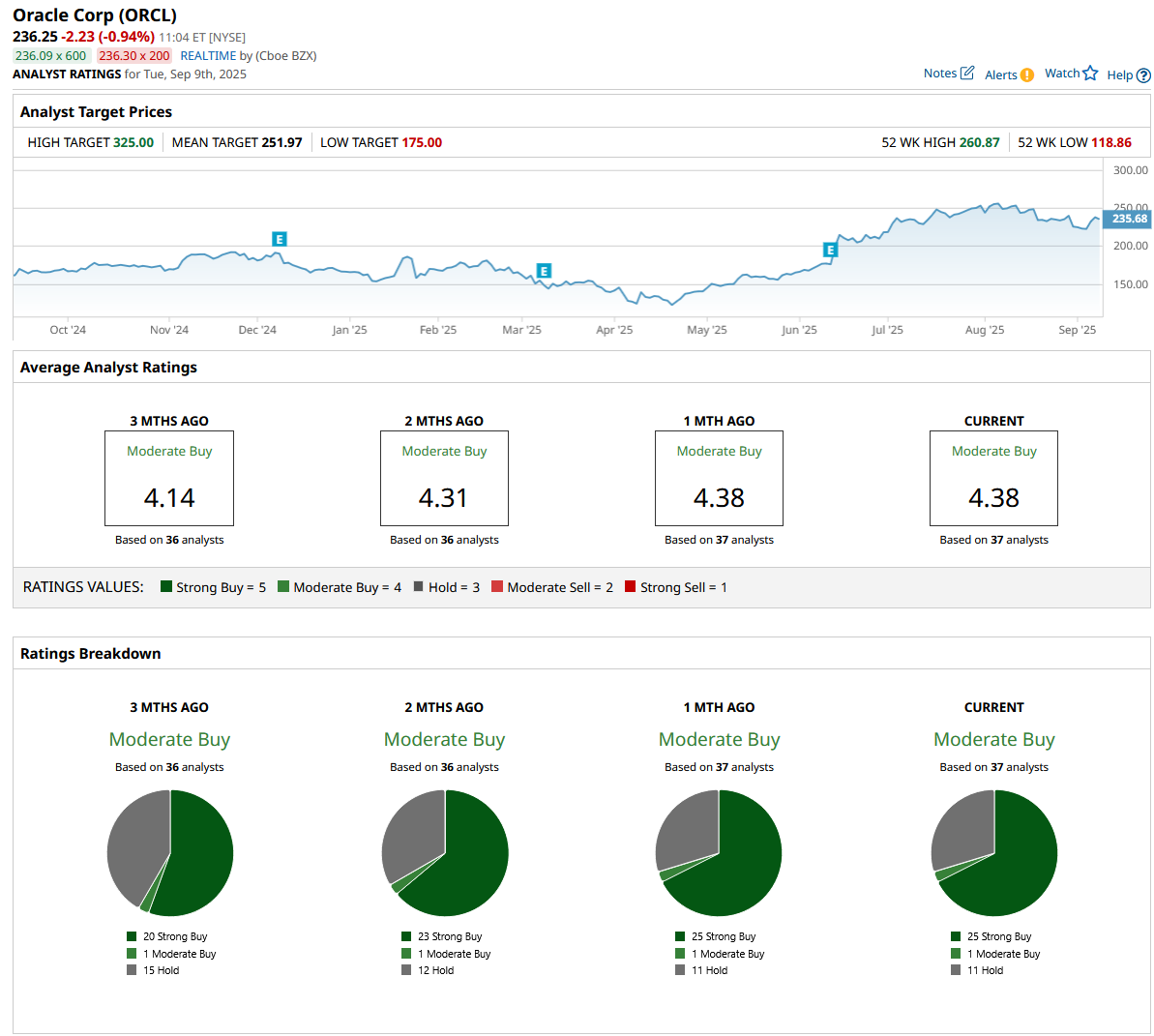

Based on solid demand for AI-fueled cloud infrastructure, ORCL stock has been growing robustly. Over the past 52 weeks, the stock has gained 68.6%, while it is up by 41.5% year-to-date (YTD). It had reached a 52-week high of $260.87 in July but is down 9.6% from this high.

Oracle’s valuation is comparatively stretched at the moment. Its price sits at 53.64 times its earnings, which is higher than the industrial average of 29.20 times.

Oracle Topped Estimates In Its Last Reported Quarter

On June 11, Oracle reported solid growth in its results for the fourth quarter of fiscal 2025 (the quarter that ended May 31). The company’s total revenue increased 11% year-over-year (YoY) to $15.9 billion. This was also higher than the $15.6 billion that Wall Street analysts were expecting.

At the heart of this growth was Oracle’s cloud services and license support segment, which recorded topline growth of 14% from the prior year’s period, reaching $11.70 billion.

Oracle also reported expansion in its multicloud operations. Its multicloud database revenue from Amazon (AMZN), Alphabet (GOOG) (GOOGL) and Microsoft's (MSFT) Azure grew 115% sequentially from Q3 to Q4. On top of it, revenue from Oracle Cloud@Customer data centers grew 104% YoY. On aggregate, Oracle cloud infrastructure consumption revenue grew 62% in the fiscal fourth quarter.

The company’s profitability is also growing. In Q4, its adjusted operating income was $7.04 billion, a 5% increase from the year-ago value. Its adjusted EPS for the quarter was $1.70, which also grew 4% YoY, and was greater than the $1.64 figure that Wall Street analysts were expecting.

Oracle has high hopes for the current fiscal year, with management expecting fiscal 2026 to show higher revenue growth. The company’s total cloud growth is expected to increase from 24% in FY2025 to over 40% in FY2026. The growth rate of cloud infrastructure is likely to rise from 50% to over 70%, while RPO is projected to grow by more than 100% in the current fiscal year.

Wall Street analysts are optimistic about Oracle’s future earnings. For the current fiscal year, EPS is projected to increase 20.7% annually to $5.31, followed by a 13.8% growth to $6.04 in the next fiscal year. On the other hand, for Q1 of FY2026 (which is set to be reported on Sept. 9 after the market closes), the company’s EPS is expected to drop modestly by 2.5% YoY to $1.15.

What Do Analysts Think About ORCL Stock?

Wall Street analysts are bullish on the growth prospects for ORCL stock. In August, analysts at Mizuho maintained their “Outperform” rating on the stock, while raising the price target from $245 to $300. Mizuho analysts cited the company’s market position as a “structural AI winner” at the beginning stages of the enterprise AI revolution, which is picking up pace.

In the same month, analysts at TD Cowen maintained their “Buy” rating on Oracle’s shares while raising the price target from $275 to $325, indicating bullish sentiments regarding the stock. Citing Oracle’s ongoing cloud transition and the company’s prospects as a hyperscaler, analysts at Bernstein SocGen Group maintained their “Outperform” rating on the stock while raising the price target from $269 to $308.

Oracle is a popular name on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 37 analysts rating the stock, 25 of them have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and 11 analysts are playing it safe with a “Hold” rating. The consensus price target of $251.97 represents an 8.2% upside from current levels. However, the Street-high TD Cowen-given price target of $325 indicates a 39.6% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.